Discover the real opinions, perceptions and ideas of your (potential) customers

Scroll down

focus groups & in-depth interviews

As an organization, you like to stay informed about the perceptions and opinions of your target groups. To get an in-depth picture of this, you can turn to qualitative market research such as focus groups and in-depth interviews.

Through qualitative market research, we map the perceptions, opinions and ideas of your (potential) customers.

We explore what your customers are sensitive to and how to reach them with the greatest impact.

Fast forward to:

How we helped Welbi with market research

Scroll down

What we do:

Focus groups &

in-depth interviews

What is a

focus group?

Duration: around 1,5 – 2 hours

Location: external location, incl. video equipment and mirror glass

Requirements: discussion guide

What is a

diepte-interview?

Duration: around 1,5 – 2 hours

Location: remote location (or videocall)

Requirements: discussion guide

Scroll down

Market Research

case

To identify the perceptions and desires of the different target groups, we conducted numerous in-depth interviews for Welbi. We poured the findings into an easy-to-understand report.

In addition, we helped and are helping to put the recommendations into practice.

Welbi

Helping hands marketeer around the corner

› analysis

› strategy

› consultancy

Scroll down

How

do we proceed?

1

We listen to you. What strategic challenges are at play? What exactly do you want to find out? What do you already know …

2

Determining target groups

What target groups should we distinguish? What do we want to find out for each target group?

3

Recruitment

After determining the target groups, we begin recruitment for the market research. We always recruit a few more participants than strictly necessary. After all, a last-minute cancellation is always possible.

4

Drafting discussion guide

The discussion guide is the moderator’s guide to content. This is based on input from the strategic workshops and/or further meetings with you.

One discussion guide is prepared for each target group.

5

We appoint a moderator and – in the case of focus groups – a note taker.

6

Report

After analysing the market surveys, we pour them into a clear report, broken down by target group. An accurate and neutral presentation of the results is crucial. After all, these are vital inputs.

NEXT

And after market research?

The insights from the market research form the foundation for your further marketing and communication. We always use these e.g. as input for the strategic workshops.

In addition, it is important to continue to raise insights in the long term. This can be done perfectly through periodic meetings throughout the year. We watch over the insights and make sure they are and remain woven into all marketing tools and communication campaigns.

Know more?

Contact Koen. He will be happy to help you.

evidence-based

specialists in strategy

100% focused on impact

Frequently

asked questions

What is the added value of qualitative market research?

The insights from quality market research are golden for your organisation. After all, our behaviour is driven by perceptions, thresholds, ideas and opinions. Only qualitative research explores exactly what these mean and how you can (possibly) steer them.

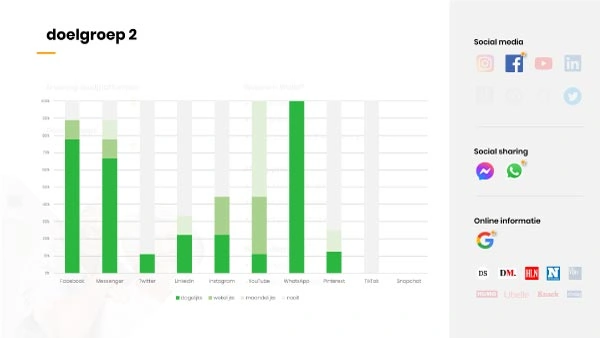

Quantitative vs qualitative market research?

Briefly, quantitative market research allows you to confirm or not confirm certain statements, without going into further detail. Quantitative research gives you numerical facts. Results are often cast in graphs and tables.

Conducting qualitative research does allow us to go into detail and elaborate on certain aspects. It allows us to probe for deeper and often unconscious issues. Findings from a qualitative research are translated into a clear report with insights, caveats, recommendations, etc.

→ Learn more in this article.

When do you choose in-depth interviews?

In-depth interviews are appropriate when only a limited number of respondents is available and/or when the information may not be shared with other respondents (e.g. for confidentiality reasons). In addition, the budget to be provided for in-depth interviews is often lower than for focus groups.

See also our article In-depth interview or focus group?

When do you choose focus groups?

It is very important that respondents can chat freely. In focus groups, the conversation takes place in a group, so the participants do not feel (or at least a lot less) targeted individually. As a result, they are more at ease and the input they give is a lot more in-depth.

In addition, in focus groups you work with homogeneous groups in which participants have a lot in common. When participants have similarities, they feel more comfortable and speak more freely. Negative peer pressure, on the other hand, can cause opinions to be kept to themselves and even adjusted à la minute to meet group approval.

See also our article In-depth interview or focus group?

What should you look for in depth interviews?

In-depth interviews can be golden for your organization. However, it is important that they are conducted correctly.

Our experience tells us that when doing in-depth interviews, you should definitely pay attention to three points: 1) inhibitions, 2) generalizations and 3) facial expressions and body language.

Learn more in our article In-depth interview or focus group?

What should you watch out for in focus groups?

Learn more in our article In-depth interview or focus group?

How many focus groups do I best organize?

For each homogeneous group, you should provide at least one focus group, although we actually recommend at least two. Since you can most likely split your customer base into several homogeneous groups, you will soon need several focus groups to come up with valid results.

How many in-depth interviews do I need?

It depends on your target audience(s). It is best to divide these into several homogeneous (sub)groups.

We recommend surveying at least 10 respondents per subgroup to achieve representative results.

Specifically, how does a focus group work?

There are several steps to follow.

- Determining target groups

- Recruitment

- Discussion Guide

- Moderator & note taker

- Reporting

- Guidance throughout the year

In this comprehensive roadmap, you’ll find out what each step entails specifically.

What about after the market research?

The insights from market research provide the foundation for your continued marketing and communications. We always use these e.g. as input for the strategic workshops.

In addition, it is important to continue to raise insights in the long term. This can be done perfectly through periodic meetings throughout the year. We watch over the insights and make sure they are and remain woven into all marketing tools and communication campaigns.

Is market research something for my organization?

The insights that market research can provide are so crucial that we at BDDB strongly believe in its power and thus often recommend it.

In addition, it is at least as important to then use (and supplement) the insights during the further development of your strategy, this can be done e.g. during strategic workshops.

Related

articles

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

we invest

20%

of our time in

study & development

As an SME, receive up to

30% financial support

At BDDB we are certified as a recognized service provider of the Flemish Government (KMO Portefeuille). As a Flemish SME you can receive up to 30% financial support for advice & training if certain conditions are met.

What

do we do?

strategic

workshops

marketing

consultancy

market

research

implementation

online & offline

evidence-based

specialists in strategy

100% focused on impact

They preceded you

Cases

from customers

RouteYou

Better and more beautiful routes with RouteYou

› analyse

› strategy

› guidance & optimization

Helping handsmarketeer

around the corner

DD Engineering

Engineering the factories of tomorrow

evidence-based

specialists in strategy

100% focused on impact

Get

in touch

Feel free to contact us. We are happy to help you.